MR emailed me recently asking me to look at part of a review by RM of his recent book. As you can see, the review says the book's theory is "remarkable", quotes at length including a diagram, and then implies that the theory is wrong, without saying why.

MR wondered if he and his co-author had made some obvious mistake and if I'd explain it to him.

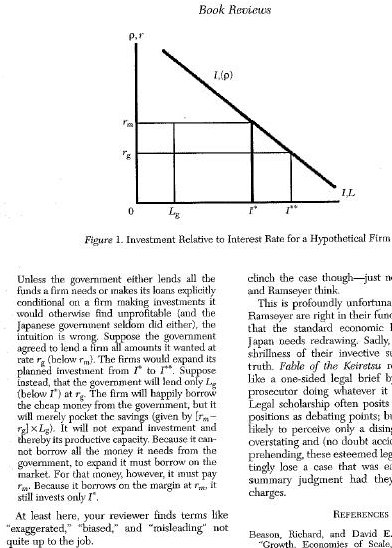

I was equally puzzled, though. Maybe they should have used a numerical example. Suppose that a Japanese company invests 10 billion yen because it has to pay a 4% interest rate to borrow the money in the private financial markets and the last yen of those 10 billion invested would have a return of 4%. If they invested another billion yen, they'd only get 3%, having to go to worse projects, so they don't. But then the Japanese government offers to lend them the 10 billion at an interest rate of 2%. They eagerly take up the offer of course. But they still don't invest more than 10 billion. If they invested another billion by borrowing at 4% from the private sector, they'd still only get a 3% return and they'd lose money. Thus, government lending meant to increase investment won't succeed unless the government lends more than a private company was originally borrowing. Put more technically, this is an example of how inframarginal price changes have zero effect on real behavior.

I was equally puzzled, though. Maybe they should have used a numerical example. Suppose that a Japanese company invests 10 billion yen because it has to pay a 4% interest rate to borrow the money in the private financial markets and the last yen of those 10 billion invested would have a return of 4%. If they invested another billion yen, they'd only get 3%, having to go to worse projects, so they don't. But then the Japanese government offers to lend them the 10 billion at an interest rate of 2%. They eagerly take up the offer of course. But they still don't invest more than 10 billion. If they invested another billion by borrowing at 4% from the private sector, they'd still only get a 3% return and they'd lose money. Thus, government lending meant to increase investment won't succeed unless the government lends more than a private company was originally borrowing. Put more technically, this is an example of how inframarginal price changes have zero effect on real behavior.

That idea is correct, unless I'm missing something big, and it looks to me as if the explanation above is correct too. Am I missing anything?

I think there are two morals to the story. First, simple Chicago-style price theory really is remarkable. It can surprise even an experienced, much-published economist. Second, when criticizing someone's ideas in print it's a good idea to send a copy to them to see if they have a response you hadn't thought of.

December 2: Someone suggested that even an inframarginal subsidy would increase investment via its effect on the probability of bankruptcy. A firm which has a subsidy will be more profitable, and hence less likely to go bankrupt, and hence will be able to borrow more cheaply, and hence will invest more. That sounds right. A lump sum subsidy would have the same effect.

![]()

![]()

![]()

![]()

<< Home